In late 2014 our prudential regulator warned banks that the percentage of investment loans needed to decrease. Months later, APRA instigated some tough and noticeable changes and investment lending scrutiny began.

The consumer outcries at the time were mostly in relation to the new differential in interest rates. Investment mortgage rates had sat in line with home rates for some years, but many investors had forgotten the past years of the two-speed lending rates.

Little did we know that hiked interest rates were to be the least of our challenges.

Fast forward three years and our lending landscape is arguably tougher now than it was in the wake of the Global Financial Crisis. Loan servicing calculators now factor in much higher repayment commitments than actual (above 7%, and are based on principle AND interest repayments over the remaining loan term for ALL loans).

Fast forward three years and our lending landscape is arguably tougher now than it was in the wake of the Global Financial Crisis. Loan servicing calculators now factor in much higher repayment commitments than actual (above 7%, and are based on principle AND interest repayments over the remaining loan term for ALL loans).

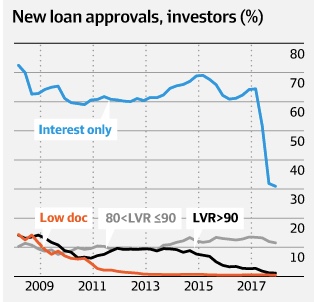

The affect of the changes is palpable in our marketplace and this chart shows the downturn in Interest Only loan approvals, tightened conditions for borrowers who require Lender’s Mortgage Insurance (LMI applies for loans above 80% borrowings), and the total and complete end to Low Doc loans.

Not only are investment loans very difficult to obtain for the seasoned investors, but home loans are challenging too; and for different reasons.

We are in the midst of a tumultuous set of conditions; some relating to the general clampdown on investment lending, and other more recent changes relating to responsible lending. The fallout from the Royal Commission has taken grip and bank assessors are now focusing on individuals’ spending habits like never before.

Brokers are being asked to explain charges and expenditures for as little as $40 on bank statements.

What this all means for borrowers is that the need for an official, bank-letterhead style pre-approval is more important than ever.

Relying on the say-so of a lender’s willingness to lend money is unwise, and despite teh assurances of bank employees or online calculators, an indicative pre-approval is not enough. Indicative pre-approvals come in many forms, some of which include:

- Online portals churning out a pre-approved limit figure after the applicant has punched in their details

- Over the phone advice

- Personal or private bankers advising lending ‘should be’ ok

- Old lapsed pre-approval (people can assume that because their situation hasn’t changed since the pre-approval lapsed, the bank’s willingness to loan to them is unchanged also)

Lending policy is changing by the day and some borrowers find themselves ineligible at the worst possible time.

Obtaining genuine pre-approval relies on the bank’s assessment being conducted with an applicant’s supporting documentation, including payslips, records of savings, credit card statements, identification, and multiple other documents. The lender needs clear visibility on employment status, debt repayment conduct, lifestyle obligations and ‘character’ of the applicant. An online portal or say-so of an employee does not address any of these highly scrutinised aspects.

The risk to buyers who purchase without lending pre-approval firmly in place is significant. For those who insist on making purchase offers ‘subject to finance’, their options in capital cities boasting high auction numbers are significantly reduced because auction sales do not cater to conditional offers. Private sale properties generally enable buyers to include finance conditions, but buyers need to accept that vendors will favour a competing unconditional offer and they will find themselves constantly getting pipped by other buyers.

The risk to buyers who purchase without lending pre-approval firmly in place is significant. For those who insist on making purchase offers ‘subject to finance’, their options in capital cities boasting high auction numbers are significantly reduced because auction sales do not cater to conditional offers. Private sale properties generally enable buyers to include finance conditions, but buyers need to accept that vendors will favour a competing unconditional offer and they will find themselves constantly getting pipped by other buyers.

The risk for those who do sign up for an unconditional purchase and later discover that they are ineligible for the loan they assumed they’d get face nightmarish options.

The best case scenario could be as dire as obtaining hefty loan rates from a lender catering to higher risk applicants. The worst case scenario is that the buyer could default on the purchase, be served a recision notice and would not only forfeit their deposit, but be sued for the financial damages caused to the seller. In a softening market, this could include the price differential between their contract price and the next buyer’s price.

In our office we diarise our clients’ pre-approval validity dates and require them to send us updated pre-approval advice if their three or six month periods lapse.

Being relaxed about lending is not an option.