Land to Asset Ratio is not a plentiful term in our industry, but it should be.

It literally means ‘the ratio of the land content to the total asset value.’ The term has a few variants, but they all refer to the value of the land when benchmarked against the value of any dwelling plus improvements on this land. A Melbourne-based property planner, David Johnston registered the term early in the last decade and continues to explain it’s powerful use for measuring the health of a property’s prospects.

A recent catch up with Pete Wargent and David prompted this blog idea to not only share the benefit of this easy rule of thumb, but to also digest the deficiencies, limitations and investor-specific use of it.

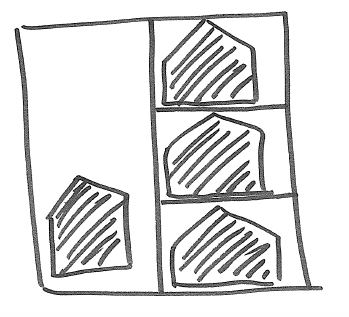

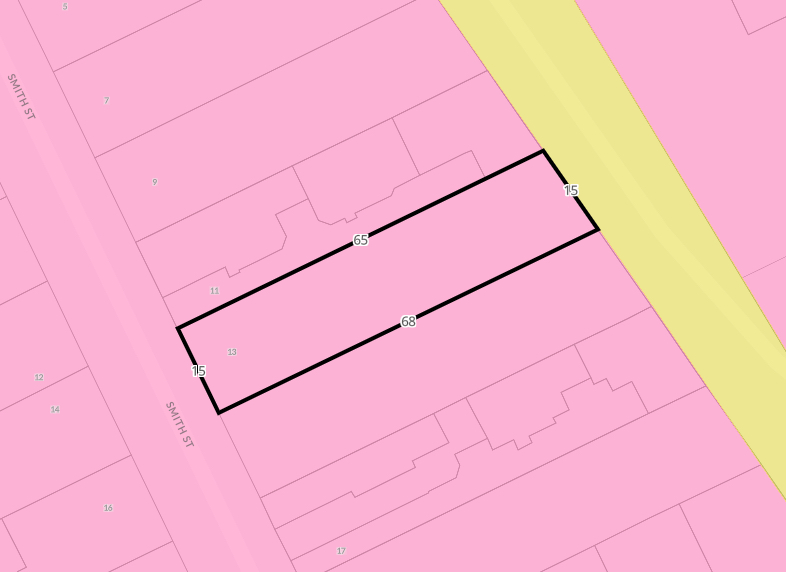

Let’s unpack it’s meaning. Take this example in Carrum… the opportunity for the buyer who purchased this house on nearly 1000sqm of land is likely that of potential development. The subdivided allotment directly next to it demonstrates what this land could possibly become. If we contrast the two neighbouring allotments, the Land to Asset Ratio concept comes alive.

The house at 13 Smith St sold for just shy of $1M. Let’s assume the old house on it has depreciated over the years to a current value of $50,000. That would make the Land to Asset Ratio a bolstering 95%. The land component is represented by the vast majority of the value.

As land appreciates and dwellings depreciate, it is fair to say that the capital growth prospects of this property on Smith St are indeed very strong. The rate of growth surpasses the rate of depreciation (or value loss). The diminishing value of the dwelling is tiny, because the dwelling portion is only worth $50,000 at the time of purchase. The land portion, however represents $950,000. At a conservative estimate of 5% pa capital growth, the land gains circa $50,000 of growth in the first year.

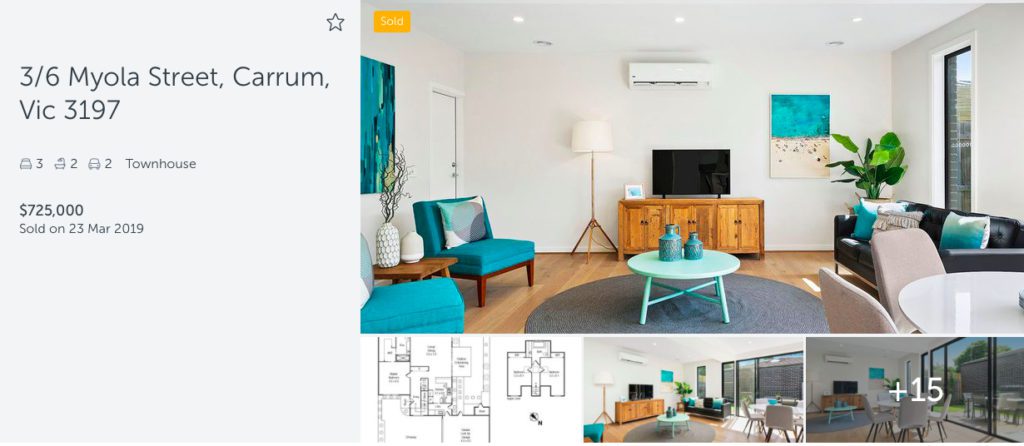

Let’s consider a new townhouse on a block of three in the same neighbourhood. This gorgeous 3BR property sold a few months ago for $725,000. Knowing that the value of the former site’s land would have been circa $950,000 (from the approximate example above), we can calculate broadly that the land value of this particular parcel is circa $315,000.

That makes the Land to Asset Ratio 43%.

The rate of depreciation would eclipse the rate of appreciation. That means the buyer is likely to see their property value diminish in the first few years of ownership.

It’s like driving a brand new car off the lot. It depreciates immediately, and is coming off it’s highest base when brand new.

So, what are the limitations of using the Land to Asset Ratio concept?

- It isn’t an exacting science. Analysing the precise square meterage dollar value of a block is impossible. Variables like orientation, slope, ‘highest and best use’, zoning, overlays, easements, neighbours, noise, street quality, market timing, competing buyers on the day, etc. all impact. It’s only an approximating science. Like the above examples, the land sale of one site can’t determine the other site’s value. It can only indicate what another developer will likely pay in the same market.

- Aiming for higher Land to Asset Ratio in the quest for maximised capital growth comes with downside.

Firstly, the dwelling will be particularly rugged if the ratio is high. If tenanted, this will precipitate tenant grumbles, requests for improvement, lower rental prospects and possibly a less desirable tenant.

Secondly, the cashflow equation will be harder on the investor. Lower rent and higher maintenance expenses will only further impact the heightened price tag that was required to secure the generous allotment of land.

David cites an ‘ideal’ ratio. He aims for around 70%. I’m not so prescriptive and I can forgive an asset with a ratio closer to 85% pending the investor’s willingness to manage the tenant’s rights and expectations.

What I do avoid is a Land to Asset Ratio of 50% or less.