First homebuyer challenges are often a topic of discussion in politics, media, and of course socially, at BBQ’s, dinner parties and within social circles. Plenty of people weigh in with their thoughts about whether incentives are the right way to support those entering the market, and statisticians and produced interesting trends to demonstrate the affect of some of these initiatives.

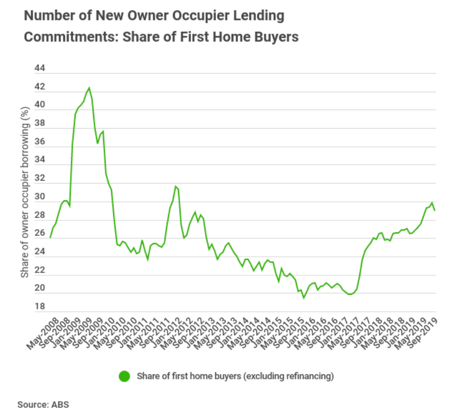

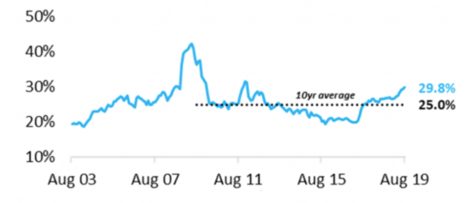

An interesting observation over the last few years is the increase in first home buyer purchasing activity as a percentage of all owner occupier lending.

There are various reasons for this, however the combination of record low interest rates and multiple incentives are the obvious answers. As Cameron Kusher points out in this article, the data suggests that conditions for first home buyers have continued to remain enticing, even in 2020.

The chart below shows first homebuyer activity as at 2019 was sitting above the ten year average, spiking at almost 30% of all owner occupier borrower activity.

Declines in investor activity from 2016 to 2019 marked an opportunity for first homebuyers, as our Prudential Regulator (APRA) stepped up the controls around Australian bank lending to property investors. We saw this restriction executed in the following ways;

- increase of the ‘servicing’ rate for borrowers

- decrease in maximum loan to value ratios (LVR)

- higher scrutiny on loan applications

- restriction on interest only loans

- higher interest rates applied to investment lending

- servicing buffers applied to all existing loans of the applicant

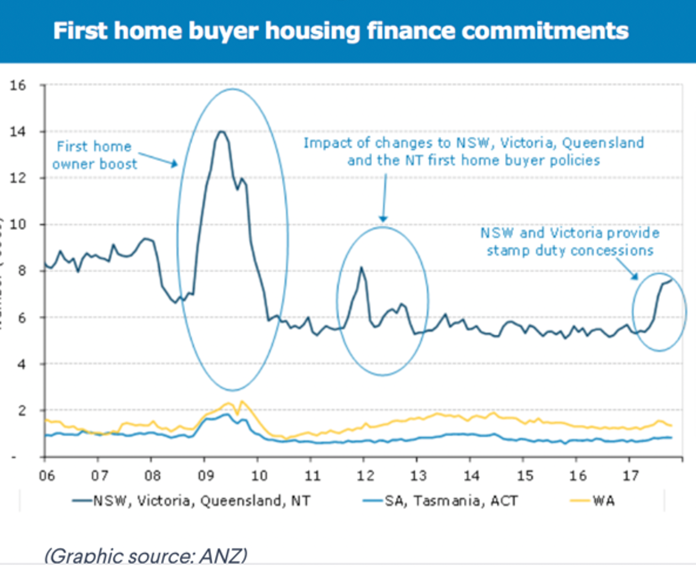

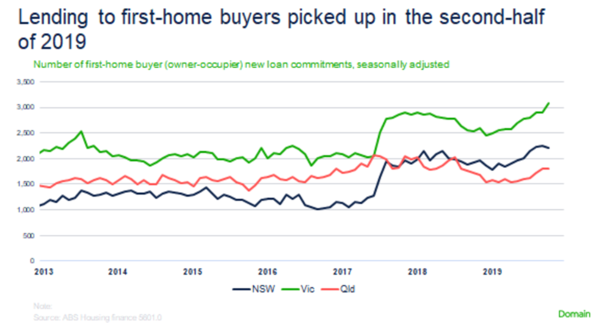

At the same time, and in line with a combination of both Federal and State Government offerings directed at first homebuyers, we witnessed a sharp increase in first homebuyer activity, particularly from mid 2017.

In Victoria, this notable increase coincided with stamp duty concession alterations. Our State Revenue Office calculations for land stamp duty for eligible first home buyers shifted from a partial discount to a full discount up to the $600,000 purchase price level.

Since this time, we have seen the State Government introduction of new building grants, regional grants and shared-equity schemes. The recent first home loan deposit scheme has fuelled more buyer activity although the limited number of places available for the scheme has meant that an increase first homebuyer numbers as a direct result of the scheme has been marginal. The stamp duty concessions remain the most valuable discount for established property buyers, and the grants for new builds have had a strong impact on the new dwelling segments of our market.

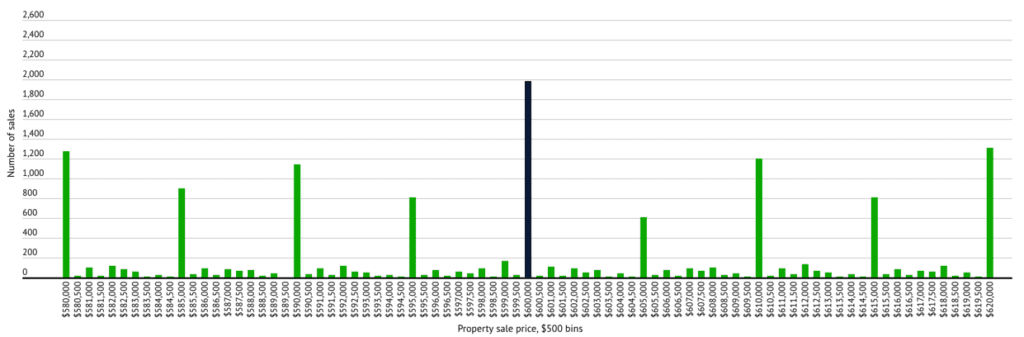

The histogram below shows Victorian purchase activity, ‘bunched’ in price-point increments. The count includes $5,000 increments up to the nominated figure, eg. $595,001 – $600,000.

“In all Australian states that offer stamp duty exemptions to first-home buyers, large clusters of property purchases occur at or just below the point where the first-home buyer stamp duty exemption ends.

Although the below graphs includes all purchases, it is likely that first-home buyer behaviour has driven this bunching. “Source: Domain Group

What is really interesting is that the “bunching” of data in our various states reveals a specific tax-avoidance buyer behaviour. Despite the fact that our stamp duty concession has been designed to only incrementally increase above the initial threshold, first homebuyers are evidently making a firm decision to cap their spend right on the threshold.

A reluctance to incur any stamp duty costs is evident.

As pointed out in this article, “The clustering of sales at and just below the stamp duty exemption thresholds would make sense if the full rate of stamp duty was charged just above the cut-offs. But this is not the case.

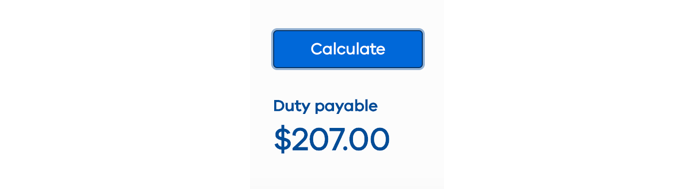

All schemes are designed so that the stamp duty paid by first-home buyers phases in slowly. For example in Victoria the stamp duty payable is just $207 at $1000 over the threshold (e.g. for a home bought for $601,000, stamp duty payable is just 0.03 per cent of the purchase price).”

What we often discuss with first homebuyers when it comes to budget-setting is to consider the overall impact of the benefits on offer, the cost of any incremental stamp duty charges, and the risk that they face if their budget cap matches a large number of other first home buyers’.

Sometimes a bid of $601,000 can be the winning bid, and the $207 has been a worthwhile token duty.

SRO Stamp duty calculator here: https://www.e-business.sro.vic.gov.au/calculators/land-transfer-duty

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU