Investors like to keep an ear to the ground when it comes to market performance, but in a transitioning market, buyers and investors sometimes make some terrible mistakes.

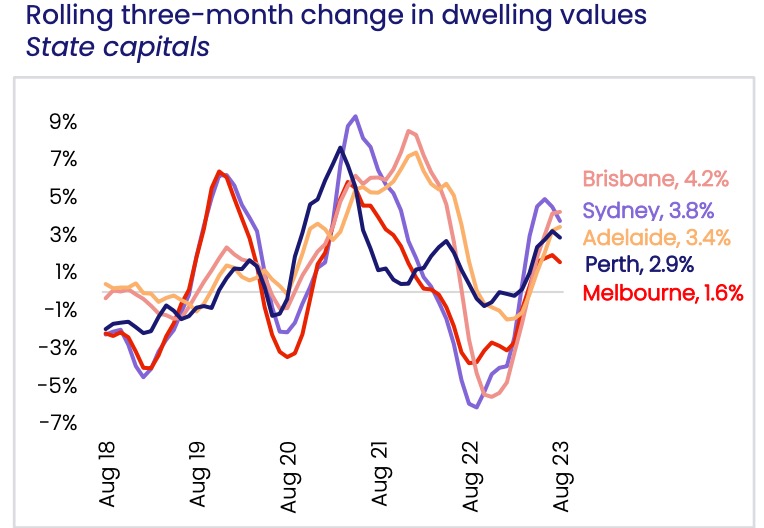

We currently find ourselves in a transitioning market now, after 2022’s downturn which was triggered by aggressive interest rate rises. These rises were initiated over consecutive months with little reprieve in an effort to curb inflation. While many have been waiting it out to time the “mortgage cliff” downturn, it’s become quite clear that our markets have been resilient across many capital cities and some regions. Whether it be new arrivals boosting demand, tight unemployment enabling confidence, or a recovering supply chain showing signs of hope, the market hasn’t quite behaved how many thought it would; particularly the Melbourne market.

So, what are some of the mistakes I see people making when our market is transitioning again?

Listening to everything in the media – let’s face it. Bad stories sell better than good ones. I’ve worked professionally through so many market downturn cycles now and it’s always the same. I used to feel surprised when a journalist would interview me on a doomsayer story, followed by a positive story in the space of a fortnight. Now, I am hardly surprised. Buyers need to think back to all of the suggestions of market crashes, bubble-housing markets, lending cliffs, COVID-related market collapses, and major bank predictions. They also need to recall the countless times that banks have reserved the right to update their predictions entirely. Sentiment counts for a lot of poor property decisions, and sadly it is often unfounded negative sentiment that gets investors into strife.

Relying too acutely on the data – While data can be great, it’s not always reliable. But even when it comes to reliable data, we have to understand what the term ‘median’ means, and we also have to understand the data sample. For example, if a suburb is adorned with a skyline full of cranes and a vast number of new, 1BR apartments hitting the market, it is fair to assume that the mid-point price tag in that data sample will likely be low, given the price of a typical 1BR apartment. If that suburb is quite small in dwelling count, the median figure will be particularly low at that point in time when the developers release their stock. This doesn’t make this suburb a poor-performer. It just showcases a lower median price for that given month.

The other consideration that we need to apply when it comes to fielding the data is that of data-lag. Not all sale prices are registered with the data house at the time of sale. For some, it can span months until the data is released. Often, the market has already turned before the data is telling the consumers it’s turned.

I went on the record late last year, suggesting that our Melbourne market had bottomed in late November/early December 2022.

Although the data didn’t support this at the time, it does now.

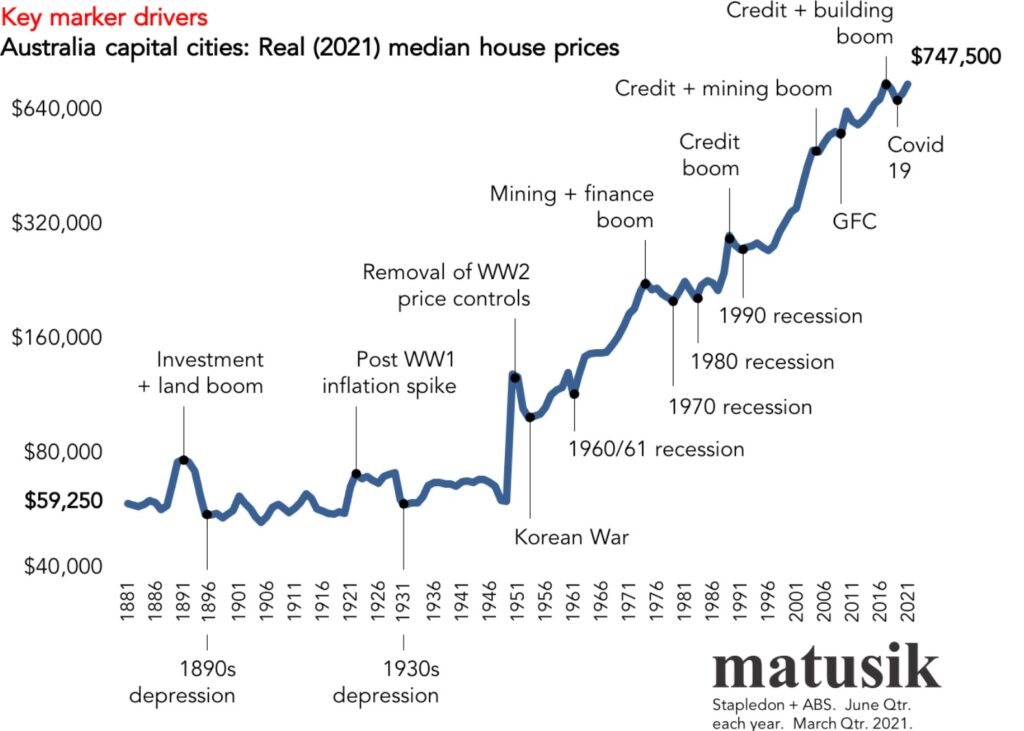

Adopting a ‘trader’ mentality – this can cause strife for the best of investors. As soon as they treat the task of property investing like a trader’s room, they risk not only their possible long term gains, but they erode their equity, (profits) with high trading costs. Unlike a parcel of shares on an E-trade account, the stamp duty and selling fees for property are much higher. Aside from those who are ‘flipping’ a property, a dedicated property investor should always maintain a long-term approach. It is this mindset, (and willingness to ride storms) is what rewards property investors into retirement.

This fantastic Matusik chart below shows that, despite downturns and triggers, the Australian property market has continued to perform long term.

Assuming it’s bargain-land after the pendulum has actually swung – some buyers don’t get the memo. They may have been over-investing in poor media reporting, or perhaps they have convinced themselves that the market is in a downward spiral. Whatever the reason, these buyers are the ones who continue to throw around low-ball offers after the market has gained upward momentum. Sadly, this approach is useless once the supply and demand ratio has swung.

Interestingly, despite a lot of rhetoric about tough market conditions and price cliffs following COVID and subsequent inflation woes, our stock levels remained so tight that buying conditions were still challenging for active buyers. Our supply and demand ratio favoured vendors in a lot of market and this has been reflected in modest price gains throughout 2023.

Panic buying – We saw it following COVID and we’ll see it again. Buyers who have sat on the sidelines, waiting for that bell to ring will jump back in when they realise that the market conditions have turned. The most favourable market conditions are those that enable buyers to target quality properties for reduced prices, amongst reduced competition levels. Once the herds are back on the auction circuit, those opportunities are diminished. They aren’t gone, but the conditions are tougher. Those who panic often forget rationality. Irrational purchases can result in either premium prices, or worse-still, poor quality assets.

The best time to buy is when you can afford to. And the best way to approach buying is to cast ‘timing the market’ to one side, and focus on a quality asset.

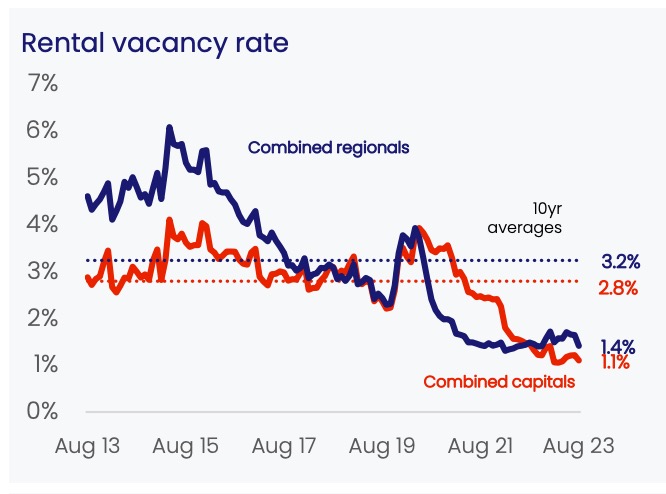

Forgetting their original strategy – for those who bought investments for a balance of growth and yield, (and particularly those who targeted high-yielding rental properties to supplement their income in retirement), selling a property due to relative underperformance capital growth is not wise. Aside from wasting cashflow gains on stamp duty and selling cost, they are unravelling the strategy they initially set up. Yields are stronger for property investors now that our nation has a chronic undersupply of rental properties. Vacancy rates are tight, and the free market has done it’s thing in terms of rental growth. Just because a property has sluggish capital growth returns doesn’t deem it a dud if the investment strategy hinged on rental yield.

Being cognisant of market forces and economic challenges is important, but equally too, so is not jumping at shadows.

REGISTER TO OUR NEWSLETTER

INFORMATION

CONTACT US

1A/58 ANDERSON STREET,

YARRAVILLE VIC 3013

0422 638 362

03 7000 6026

CATE@CATEBAKOS.COM.AU